Just remember who voted these clowns (crooks) into office

Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men. True they have tried, but their efforts have been cast in the pattern of an outworn tradition.

Faced by failure of credit they have proposed only the lending of more money. Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored confidence.

They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish.

The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.

Franklin D. Roosevelt, First Inaugural Address

http://nationalpriorities.org/budget-basics/federal-budget-101/spending/

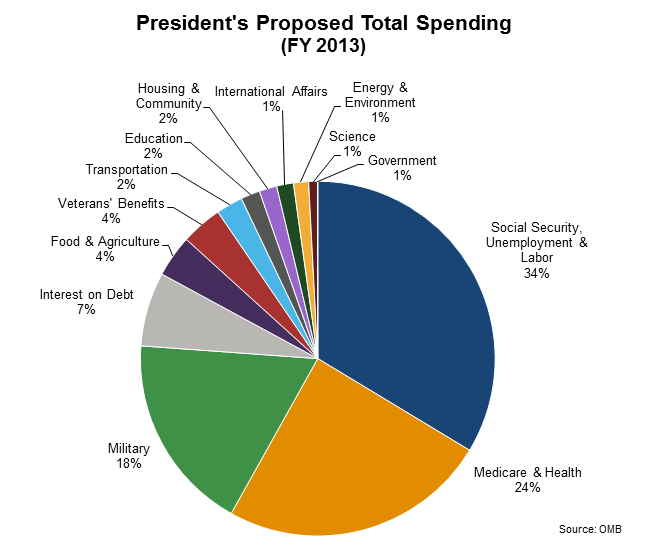

The sequestration bill cuts $85 billion from a budget of $2.9 trillion. Medicare and social security are exempt. As is CHIP.

The news this morning has Obama moaning over loss of jobs, longer wait time at airports, etc. And then blames Congress. Who signed the frick’n bill?

And, although the $85 billion in ‘cuts’ will turn into $61 billion this year, due to the recent delay included in the tax act, it’s less than 3% of the total US Government expenditure. 3%! Are they serious? After increasing everyone's payroll deduction by 3%, the Government can’t live on 3% less?

The actual amount for programs affected is 8% to 10%. There are a few exemptions, including the President’s compensation (surprise!). The link to the report is at the bottom of the list.

(a) SOCIAL SECURITY BENEFITS AND TIER I RAILROAD RETIREMENT

BENEFITS.—Benefits payable under the old-age, survivors, and disability insurance program established

under title II of the Social Security Act (42 U.S.C. 401 et seq.), and benefits payable under section 231b(a),

231b(f)(2), 231c(a), and 231c(f) of title 45 United States Code, shall be exempt from reduction under any

order issued under this part.

(b) VETERANS PROGRAMS.—The following programs shall be exempt from reduction under any order

issued under this part:

All programs administered by the Department of Veterans Affairs.

Special Benefits for Certain World War II Veterans (28–0401–0–1–701).

(c) NET INTEREST.—No reduction of payments for net interest (all of major functional category 900)

shall be made under any order issued under this part.

(d) REFUNDABLE INCOME TAX CREDITS.—Payments to individuals made pursuant to provisions of

the Internal Revenue Code of 1986 establishing refundable tax credits shall be exempt from reduction

under any order issued under this part.

(e) NON-DEFENSE UNOBLIGATED BALANCES.—Unobligated balances of budget authority carried

over from prior fiscal years, except balances in the defense category, shall be exempt from reduction under

any order issued under this part.

(f) OPTIONAL EXEMPTION OF MILITARY PERSONNEL.—

(1) IN GENERAL.—The President may, with respect to any military personnel account, exempt that

account from sequestration or provide for a lower uniform percentage reduction than would otherwise

apply.

(2) LIMITATION.—The President may not use the authority provided by paragraph (1) unless the

President notifies the Congress of the manner in which such authority will be exercised on or before the

date specified in section 254(a) for the budget year.

(g) OTHER PROGRAMS AND ACTIVITIES.—The following budget accounts and activities shall be exempt from reduction under any order issued

under this part:

Activities resulting from private donations, bequests, or voluntary contributions to the Government.

Activities financed by voluntary payments to the Government for goods or services to be provided for such

payments.

Administration of Territories, Northern Mariana Islands Covenant grants (14–0412–0–1–808). Budget “Sequestration” and Selected Program Exemptions and Special Rules

Congressional Research Service 19

Advances to the Unemployment Trust Fund and Other Funds (16–0327–0–1–600).

Black Lung Disability Trust Fund Refinancing (16–0329–0–1–601).

Bonneville Power Administration Fund and borrowing authority established pursuant to section 13 of

Public Law 93–454 (1974), as amended (89–4045–0–3–271).

Claims, Judgments, and Relief Acts (20–1895–0–1–808).

Compact of Free Association (14–0415–0–1–808).

Compensation of the President (11–0209–01–1–802).

Comptroller of the Currency, Assessment Funds (20–8413–0–8–373).

Continuing Fund, Southeastern Power Administration (89–5653–0–2–271).

Continuing Fund, Southwestern Power Administration (89–5649–0–2–271).

Dual Benefits Payments Account (60–0111–0–1–601).

Emergency Fund, Western Area Power Administration (89–5069–0–2–271).

Exchange Stabilization Fund (20–4444–0–3–155).

Farm Credit Administration Operating Expenses Fund (78–4131–0–3–351).

Farm Credit System Insurance Corporation, Farm Credit Insurance Fund (78–4171–0–3–351).

Federal Deposit Insurance Corporation, Deposit Insurance Fund (51–4596–0–4–373).

Federal Deposit Insurance Corporation, FSLIC Resolution Fund (51–4065–0–3–373).

Federal Deposit Insurance Corporation, Noninterest Bearing Transaction Account Guarantee (51–4458–0–

3–373).

Federal Deposit Insurance Corporation, Senior Unsecured Debt Guarantee (51–4457–0–3–373).

Federal Home Loan Mortgage Corporation (Freddie Mac).

Federal Housing Finance Agency, Administrative Expenses (95–5532–0–2–371).

Federal National Mortgage Corporation (Fannie Mae).

Federal Payment to the District of Columbia Judicial Retirement and Survivors Annuity Fund (20–1713–0–

1–752).

Federal Payment to the District of Columbia Pension Fund (20–1714–0–1–601).

Federal Payments to the Railroad Retirement Accounts (60–0113–0–1–601).

Federal Reserve Bank Reimbursement Fund (20–1884–0–1–803).

Financial Agent Services (20–1802–0–1–803). Budget “Sequestration” and Selected Program Exemptions and Special Rules

Congressional Research Service 20

Foreign Military Sales Trust Fund (11–8242–0–7–155).

Hazardous Waste Management, Conservation Reserve Program (12–4336–0–3–999).

Host Nation Support Fund for Relocation (97–8337–0–7–051).

Internal Revenue Collections for Puerto Rico (20–5737–0–2–806).

Intragovernmental funds, including those from which the outlays are derived primarily from resources paid

in from other government accounts, except to the extent such funds are augmented by direct appropriations

for the fiscal year during which an order is in effect.

Medical Facilities Guarantee and Loan Fund (75–9931–0–3–551).

National Credit Union Administration, Central Liquidity Facility (25–4470–0–3–373).

National Credit Union Administration, Corporate Credit Union Share Guarantee Program (25–4476–0–3–

376).

National Credit Union Administration, Credit Union Homeowners Affordability Relief Program (25–4473–

0–3–371).

National Credit Union Administration, Credit Union Share InsuranceNational Credit Union Administration, Credit Union System Investment Program (25–4474–0–3–376).

National Credit Union Administration, Operating fund (25–4056–0–3–373).

National Credit Union Administration, Share Insurance Fund Corporate Debt Guarantee Program (25–

4469–0–3–376).

National Credit Union Administration, U.S. Central Federal Credit Union Capital Program (25–4475–0–3–

376).

Office of Thrift Supervision (20–4108–0–3–373).

Panama Canal Commission Compensation Fund (16–5155–0–2–602).

Payment of Vietnam and USS Pueblo prisoner-of-war claims within the Salaries and Expenses, Foreign

Claims Settlement account (15–0100–0–1–153).

Payment to Civil Service Retirement and Disability Fund (24–0200–0–1–805).

Payment to Department of Defense Medicare-Eligible Retiree Health Care Fund (97–0850–0–1–054).

Payment to Judiciary Trust Funds (10–0941–0–1–752).

Payment to Military Retirement Fund (97–0040–0–1–054).

Payment to the Foreign Service Retirement and Disability Fund (19–0540–0–1–153).

Payments to Copyright Owners (03–5175–0–2–376).

Payments to Health Care Trust Funds (75–0580–0–1–571). Budget “Sequestration” and Selected Program Exemptions and Special Rules

Congressional Research Service 21

Payment to Radiation Exposure Compensation Trust Fund (15–0333–0–1–054).

Payments to Social Security Trust Funds (28–0404–0–1–651).

Payments to the United States Territories, Fiscal Assistance (14–0418–0–1–806).

Payments to trust funds from excise taxes or other receipts properly creditable to such trust funds.

Payments to widows and heirs of deceased Members of Congress (00–0215–0–1–801).

Postal Service Fund (18–4020–0–3–372).

Radiation Exposure Compensation Trust Fund (15–8116–0–1–054).

Reimbursement to Federal Reserve Banks (20–0562–0–1–803).

Salaries of Article III judges.

Soldiers and Airmen’s Home, payment of claims (84–8930–0–7–705).

Tennessee Valley Authority Fund, except nonpower programs and activities (64–4110–0–3–999).

Tribal and Indian trust accounts within the Department of the Interior which fund prior legal obligations of

the Government or which are established pursuant to Acts of Congress regarding Federal management of

tribal real property or other fiduciary responsibilities, including but not limited to Tribal Special Fund (14–

5265–0–2–452),

Tribal Trust Fund (14–8030–0–7–452),

White Earth Settlement (14–2204–0–1–452), and Indian Water Rights and Habitat Acquisition (14–5505–

0–2–303).

United Mine Workers of America 1992 Benefit Plan (95–8260–0–7–551).

United Mine Workers of America 1993 Benefit Plan (95–8535–0–7–551).

United Mine Workers of America Combined Benefit Fund (95–8295–0–7–551).

United States Enrichment Corporation Fund (95–4054–0–3–271).

Universal Service Fund (27–5183–0–2–376).

Vaccine Injury Compensation (75–0320–0–1–551).

Vaccine Injury Compensation Program Trust Fund (20–8175–0–7–551).

(B) The following Federal retirement and disability accounts and activities shall be exempt from reduction

under any order issued under this part:

Black Lung Disability Trust Fund (20–8144–0–7–601).

Central Intelligence Agency Retirement and Disability System Fund (56–3400–0–1–054).

Civil Service Retirement and Disability Fund (24–8135–0–7–602). Budget “Sequestration” and Selected Program Exemptions and Special Rules

Congressional Research Service 22

Comptrollers general retirement system (05–0107–0–1–801).

Contributions to U.S. Park Police annuity benefits, Other Permanent Appropriations (14–9924–0–2–303).

Court of Appeals for Veterans Claims Retirement Fund (95–8290–0–7–705).

Department of Defense Medicare-Eligible Retiree Health Care Fund (97–5472–0–2–551).

District of Columbia Federal Pension Fund (20–5511–0–2–601).

District of Columbia Judicial Retirement and Survivors Annuity Fund (20–8212–0–7–602).

Energy Employees Occupational Illness Compensation Fund (16–1523–0–1–053).

Foreign National Employees Separation Pay (97–8165–0–7–051).

Foreign Service National Defined Contributions Retirement Fund (19–5497–0–2–602).

Foreign Service National Separation Liability Trust Fund (19–8340–0–7–602).

Foreign Service Retirement and Disability Fund (19–8186–0–7–602).

Government Payment for Annuitants, Employees Health Benefits (24–0206–0–1–551).

Government Payment for Annuitants, Employee Life Insurance (24–0500–0–1–602).

Judicial Officers’ Retirement Fund (10–8122–0–7–602).

Judicial Survivors’ Annuities Fund (10–8110–0–7–602).

Military Retirement Fund (97–8097–0–7–602).

National Railroad Retirement Investment Trust (60–8118–0–7–601).

National Oceanic and Atmospheric Administration retirement (13–1450–0–1–306).

Pensions for former Presidents (47–0105–0–1–802).

Postal Service Retiree Health Benefits Fund (24–5391–0–2–551).

Public Safety Officer Benefits (15–0403–0–1–754).

Rail Industry Pension Fund (60–8011–0–7–601).

Retired Pay, Coast Guard (70–0602–0–1–403).

Retirement Pay and Medical Benefits for Commissioned Officers, Public Health Service (75–0379–0–1–

551).

Special Benefits for Disabled Coal Miners (16–0169–0–1–601).

Special Benefits, Federal Employees’ Compensation Act (16–1521–0–1–600).

Special Workers Compensation Expenses (16–9971–0–7–601). Budget “Sequestration” and Selected Program Exemptions and Special Rules

Congressional Research Service 23

Tax Court Judges Survivors Annuity Fund (23–8115–0–7–602).

United States Court of Federal Claims Judges’ Retirement Fund (10–8124–0–7–602).

United States Secret Service, DC Annuity (70–0400–0–1–751).

Voluntary Separation Incentive Fund (97–8335–0–7–051).

(2) Prior legal obligations of the Government in the following budget accounts and activities shall be

exempt from any order issued under this part:

Biomass Energy Development (20–0114–0–1–271).

Check Forgery Insurance Fund (20–4109–0–3–803).

Credit liquidating accounts.

Credit reestimates.

Employees Life Insurance Fund (24–8424–0–8–602).

Federal Aviation Insurance Revolving Fund (69–4120– 0–3–402).

Federal Crop Insurance Corporation Fund (12–4085–0–3–351).

Federal Emergency Management Agency, National Flood Insurance Fund (58–4236–0–3–453).

Geothermal resources development fund (89–0206–0–1–271).

Low-Rent Public Housing—Loans and Other Expenses (86–4098–0–3–604).

Maritime Administration, War Risk Insurance Revolving Fund (69–4302–0–3–403).

Natural Resource Damage Assessment Fund (14–1618–0–1–302).

Overseas Private Investment Corporation, Noncredit Account (71–4184–0–3–151).

Pension Benefit Guaranty Corporation Fund (16–4204–0–3–601).

San Joaquin Restoration Fund (14–5537–0–2–301).

Servicemembers’ Group Life Insurance Fund (36–4009–0–3–701).

Terrorism Insurance Program (20–0123–0–1–376).

(h) LOW-INCOME PROGRAMS.—The following programs shall be exempt from reduction under any

order issued under this part:

Academic Competitiveness/Smart Grant Program (91–0205–0–1–502).

Child Care Entitlement to States (75–1550–0–1–609).

Child Enrollment Contingency Fund (75–5551–0–2–551). Budget “Sequestration” and Selected Program Exemptions and Special Rules

Congressional Research Service 24

Child Nutrition Programs (with the exception of special milk programs) (12–3539–0–1–605).

Children’s Health Insurance Fund (75–0515–0–1–551).

Commodity Supplemental Food Program (12–3507–0–1–605).

Contingency Fund (75–1522–0–1–609).

Family Support Programs (75–1501–0–1–609).

Federal Pell Grants under section 401 Title IV of the Higher Education Act.

Grants to States for Medicaid (75–0512–0–1–551).

Payments for Foster Care and Permanency (75–1545–0–1–609).

Supplemental Nutrition Assistance Program (12–3505–0–1–605).

Supplemental Security Income Program (28–0406–0–1–609).

Temporary Assistance for Needy Families (75–1552–0–1–609).

(i) ECONOMIC RECOVERY PROGRAMS.—The following programs shall be exempt from reduction

under any order issued under this part:

GSE Preferred Stock Purchase Agreements (20–0125–0–1–371).

Office of Financial Stability (20–0128–0–1–376).

Special Inspector General for the Troubled Asset Relief Program (20–0133–0–1–376).

(j) SPLIT TREATMENT PROGRAMS.—Each of the following programs shall be exempt from any order

under this part to the extent that the budgetary resources of such programs are subject to obligation

limitations in appropriations bills:

Federal-Aid Highways (69–8083–0–7–401).

Highway Traffic Safety Grants (69–8020–0–7–401).

Operations and Research NHTSA and National Driver Register (69–8016–0–7–401).

Motor Carrier Safety Operations and Programs (69–8159–0–7–401).

Motor Carrier Safety Grants (69–8158–0–7–401).

Formula and Bus Grants (69–8350–0–7–401).

Grants-In-Aid for Airports (69–8106–0–7–402).(7) EXEMPTIONS FROM SEQUESTRATION.—In addition to the programs and activities specified in

section 255, the following shall be exempt from sequestration under this part:

(A) PART D LOW-INCOME SUBSIDIES.—Premium and cost-sharing subsidies under section 1860D–14

of the Social Security Act.

(B) PART D CATASTROPHIC SUBSIDY.—Payments under section 1860D–15(b) and (e)(2)(B) of the

Social Security Act.

(C) QUALIFIED INDIVIDUAL (QI) PREMIUMS.—Payments to States for coverage of Medicare costsharing for certain low-income Medicare beneficiaries under section 1933 of the Social Security Act.

The report is here: https://www.fas.org/sgp/crs/misc/R42050.pdf

No comments:

Post a Comment

You are not entitled to your opinion. You are entitled to your informed opinion. No one is entitled to be ignorant.

Harlan Ellison